Texas Equipment Appraisal: SBA & IRS Compliant Valuations.

IRS and SBA-Compliant reporting for the Permian Basin, Gulf Coast, and DFW Metroplex. Audit-ready data for high-stakes lending, litigation, and tax strategy.

USPAP Compliant

SBA Qualified

IRS Defensible

Call Now

(512) 229-9977

Rooted in a 120-Year Legacy

Texas Heavy Equipment Appraisal

Our methodology is built on the educational foundation of North America’s premier appraisal institution, established in 1905. We provide USPAP-compliant reporting that bridges the gap between field reality and federal audit standards.

Whether securing a $5M SBA infrastructure note or defending against Texas Family Code § 7.009 litigation, we deliver the technical literacy national call centers lack.

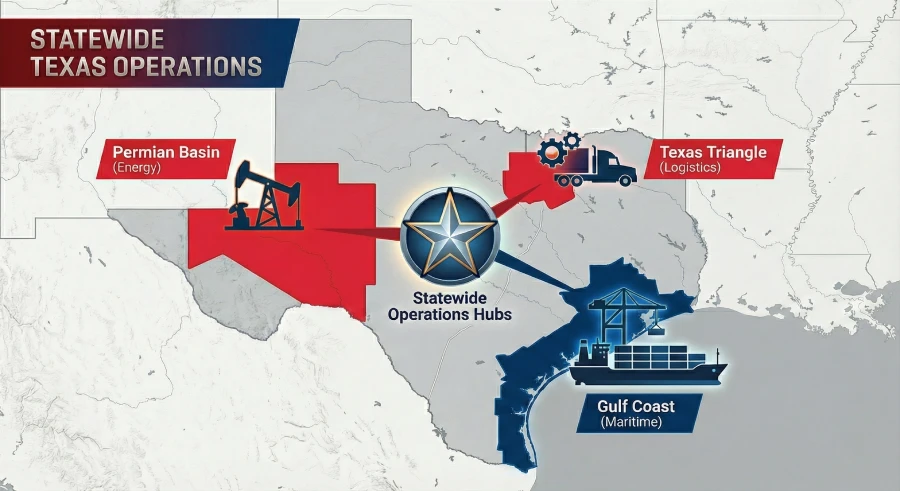

Statewide Texas Operations & Regional Field Hubs

Our field team provides rapid on-site inspections and forensic market reconciliation across Texas’s primary economic zones.

We eliminate the “outsourced subcontractor” risk of national firms by operating directly out of three strategic industrial hubs.

The Permian Basin

Specialized reporting for the high-velocity energy market. We reconcile the 24/7 duty cycles and extreme environmental wear patterns unique to the Permian Basin. Our valuations account for field reality, including caliche dust and high-hour depreciation on Sand Kings, Frac Spreads, and Coiled Tubing Units (CTU).

The Gulf Coast

Certified valuations for maritime, port, and refinery infrastructure. We provide the forensic oversight required for assets exposed to high-salinity Gulf Coast environments. From Reach Stackers and Straddle Carriers at Port Houston to Aerial Bundle Extractors in the refinery belt, we deliver audit-ready data that national call centers can’t match.

The Texas Triangle

Local oversight for the state’s primary construction and logistics corridor. We offer rapid dispatch for SBA 504 on-site inspections and desktop reporting for intermodal transport fleets. Our team specializes in “Yellow Iron” construction fleets, manufacturing tooling, and the heavy hauler assets moving through North and Central Texas.

Independent Third-Party Oversight for Law Firms, Lenders, and Operators Who Cannot Afford a Valuation Failure.

Generic national firms rely on Level-1 call scripts and outdated depreciation schedules. We close the collateral gap by reconciling Permian Basin environmental wear and Gulf Coast salinity with real-world 2025/2026 auction data.

We don’t just provide a number; we provide a defensible legal position for SBA and IRS scrutiny.

Valuations Tailored to Texas Industry

From the Permian to the Ship Channel, we bring technical literacy to every report. Whether it’s an SBA 504 expansion, tax-driven liquidation, or high-stakes Litigation, your collateral is protected.

Assets We Appraise

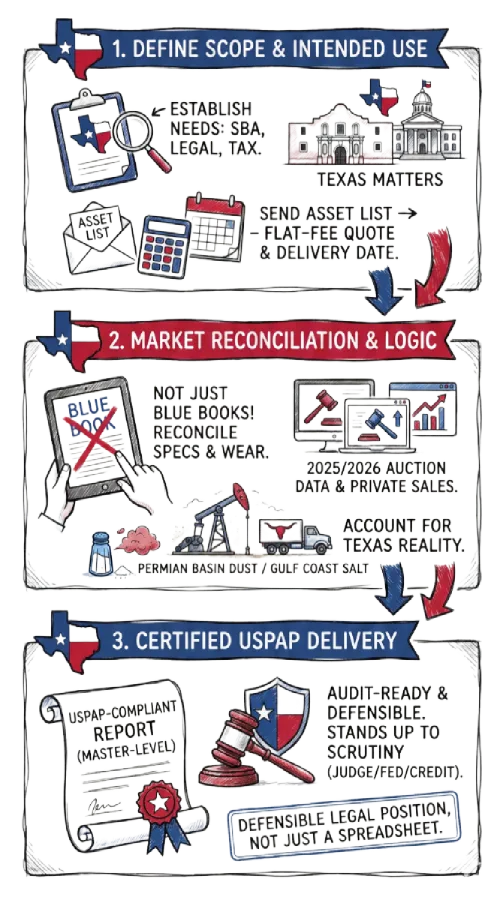

Appraisal Workflows

A Logic-Based Process for High-Stakes Texas Equipment Valuations.

1. Define Scope & Intended Use

We start by establishing exactly what you need. Whether it’s SBA 504 compliance, a Texas Family Code litigation matter, or an IRS Section 179 tax valuation, we define the “intended use” first. Send us your asset list or serial numbers, and we’ll provide a flat-fee quote and a firm delivery date based on the complexity of your fleet.

2. Market Reconciliation & Logic

We don’t just look at “blue books.” We reconcile your equipment’s technical specs and environmental wear with real-world 2025/2026 auction data and private sale records. We account for the operational reality of the Texas market (like the caliche dust of the Permian Basin or the salt-air corrosion of the Gulf Coast) to ensure the final number is rooted in reality.

3. Certified USPAP Delivery

You receive a USPAP-compliant, Senior-level certified report. While high-velocity desktop valuations can move quickly, we never sacrifice the logic for speed. Every report we sign is an “audit-ready” document engineered to withstand the scrutiny of a Senior Credit Officer, a judge, or a federal examiner. You get a defensible legal position, not just a spreadsheet.

Proven Outcomes: Defending Texas Capital

Commercial gatekeepers reject generalized data models. We provide the forensic market reconciliation required to survive the scrutiny of Texas lenders, courts, and federal examiners.

Neutralized a $450k “Collateral Gap” to secure a $3.2M infrastructure note.

Neutralized a $450k “Collateral Gap” to secure a $3.2M infrastructure note. Defeated “Fraud on the Community” claims in a $5M Permian partnership dispute.

Defeated “Fraud on the Community” claims in a $5M Permian partnership dispute. Certified $2.5M in Section 179 eligibility for a bifurcated 2025/2026 fleet acquisition.

Certified $2.5M in Section 179 eligibility for a bifurcated 2025/2026 fleet acquisition. Eliminated “Ghost Asset” taxes and a mandated 10% rendition penalty.

Eliminated “Ghost Asset” taxes and a mandated 10% rendition penalty.

Appraisal Standards: Texas Compliance FAQ

Gatekeepers and lenders require more than a number; they require a methodology that survives the scrutiny of federal and state examiners.

Call us (512) 229-9977

Lock in Your Certified Texas Heavy Equipment Appraisal

Send us your fleet details or serial numbers. We’ll establish the intended use and provide a flat-fee quote based on the operational reality of your equipment.

Texas Equipment Appraisal is a registered DBA of Heavy Equipment Appraisal LLC. Serving the State of Texas via regional field hubs in Austin, Houston, and Midland. Corporate fulfillment handled via Western Operations Hub.